ESD: A Sensible Haircut

An overview of the recently announced ESDV1.5 and what it means for ESD holders

After some recent speculation, we finally have some answers on the future direction of the Empty Set Dollar protocol.

TL;DR: the ESD token holders will take a big haircut. But in return they get access to a sensible new business model based on future cash flows. It’s still all to play for. Exciting times!

Photo by Jonathan Cooper on Unsplash

To start to understand this, let’s start by understanding the basic business model of a fiat-backed stablecoin. Take Tether or USDC as an example, where every stablecoin issued is backed by a dollar in a bank account (yes, we’re ignoring the Tether FUD here). The issuers make money by earning interest on the reserves. At the time of writing, there are 33B USDT and 7.2B USDC in circulation. So there is a sweet return to be made. But what if the stablecoins were backed by on-chain reserves? How would this change things?

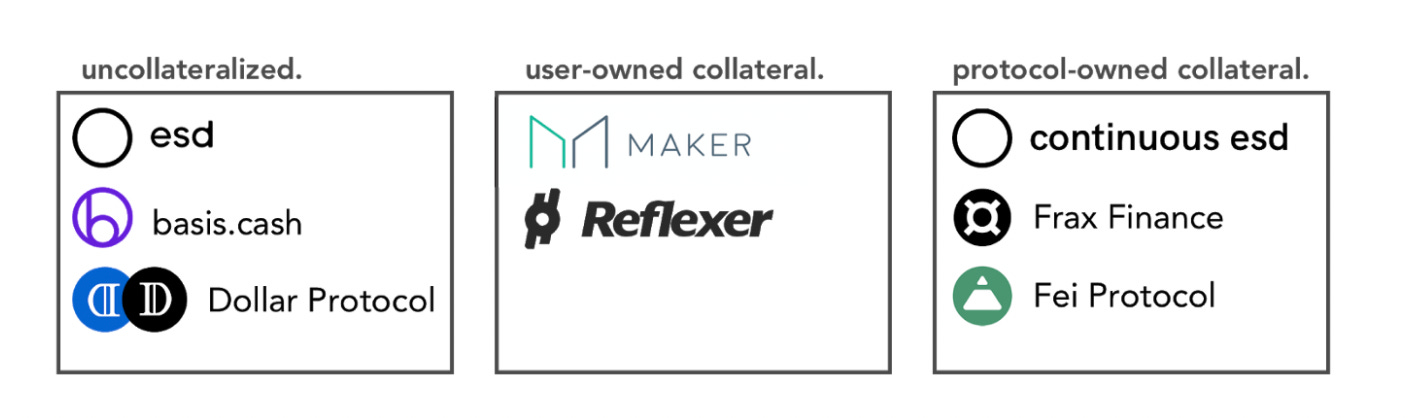

Of course, it would remove the need for auditors. With the reserves on-chain and fully transparent to everyone, it would reassure users that their exposure to the stablecoin had limited downside risk. But this is not a big deal when compared to the other benefit: an on-chain reserve can be deployed into protocols with much higher returns than those available to fiat-backed issuers. This is the insight that brought us Frax, Fei and OlympusDAO. This is the new “stablecoins with protocol-owned reserves” space. And ESD will soon compete in this space.

The ESD DAO will become a DAO to manage the protocol-owned reserves, with DAO holders likely to benefit from the investments made by the protocol. The protocol can deploy its reserves into DEX liquidity pools, money markets, yield farms and more. It’s a great opportunity. With the added kicker that the market might be ready to embrace partially-backed stablecoins, in which case the DAO might have access to higher returns than those available elsewhere as the reserve ratio is lowered over time.

This all sounds positive. So why did I call it a haircut? Is it an accurate word to use to describe the implications of the V1.5 design? I think it is. ESD V1 has a single token model but there was always a phantom token known as ESDS. ESD served as a stablecoin. But it also had another role as a governance token. Once ESD was staked in the DAO, the user received the phantom ESDS. ESDS is a restricted token. It shows up on Etherscan but it isn’t transferable. V1.5 turns this DAO token into a fully-fledged, ERC20-compliant governance token. If there was no haircut, then V1 holders would maintain their share of the DAO and hold onto their stablecoins. But this is not the case. The ESD protocol will be reset so that it starts with zero issued dollars. All ESD holders have left is their share of the DAO. It’s not too dissimilar to corporate bond holders getting wiped out and issued with equity in the company that has just defaulted. So will ESD token holders vote for this? What are the alternatives?

It’s now clear that our speculation in our previous blog post that V1.5 might bring ESD back to $1, which would make a purchase of ESD at $0.20 a great 5x investment, was severely misguided. In the post we speculated on what mechanisms might be available to a protocol valued by the market at $100M, to credibly back the 450M synthetic dollars in circulation. Would existing holders fund the reserve or would new users be asked to do it? Either way it seemed like a big mountain to climb to grow these reserves. Token holders have been hit hard by the collapse in value of the token, so they are not in a great position to start thinking about adding reserves. Asking new users to do it is wishful thinking in a highly competitive space, where other protocols could provide a better value proposition. So in retrospect it’s not surprising that a more radical solution was required.

Though we were surprised by the decision to wipe out all the ESD in existence, we do appreciate that it is a clean and swift solution. ESD holders can take the pain now and move on. Everyone still has a share in the DAO. There is huge potential. It is the most radical move possible.

With ESD trading at $0.20, the alternative would be to burn 80% of the stablecoins and have the 20% that remain be backed by ESDS. In other words a 5-for-1 ESD swap. This is more precise approach to solving the problem but it’s messy. It leaves a big doubt on how well ESD can hold its new peg given the volatility of the reserve asset. In fact, to copy a model similar to MakerDAO or Synthetix, we would need to over-collateralise the dollars issued. So maybe we need two ESDS in the reserve for every one ESD issued. In which case we need to give ESD holders a 90% haircut. So the alternative option is not that attractive either. It’s messier and it still leaves ESD holders facing a major reset. So it does seem like wiping out all the stablecoins and doing a full reset is the way to go.

It’s a bright fresh start. Everyone knows where they stand. All interests are aligned around growing ESD demand to in turn grow the value of the DAO and hence the ESDS token. It removes so much of the ESD complexity of lock-up periods, coupons, coupon redemption wars etc. It’s also so much easier for new users to understand the stablecoin security.

This new game we are playing (stablecoins with protocol-owned reserves) is just starting and the ESD community is well placed to do well. Frax is up and running and doing very well, with a $1.4B fully-diluted valuation. Fei is generating a lot of excitement. OlympusDAO has partnered with Rari Capital, with a clear path to earning returns already mapped out.

But ESD already has a key advantage: an amazing community. Linda Xie, Dan Elitzer’s Nascent fund, Mechanism Capital, Delphi Digital have all played a key role in governance. The treasury is funding work by Lewi and The Bearded Prof in Squad 2.0. There are various ongoing integrations going on. And here at Complement Capital we are about to start building ESD-based solutions, with two amazing engineers that have joined us a Partners (more details on this to come in the coming days). In addition to the great community, the protocol has had no major security issues to date. This is down to the diligence of the Empty Set Squad, combined with the top tier auditors that have reviewed the codebase, with a second audit by OpenZepplin on the way.

The market has responded favourably to the news. At the time of writing, the ESD price is up 57% since yesterday. This values the protocol at 10% of the Frax fully-diluted market cap. Frax now has a head start, in that they have issued 88M stablecoins. But it’s not a huge lead in the race to catch up with Dai (with 2.2B issued) and the fiat-backed tokens we saw above. It will take some time for the market price to settle down, as the process of price discovery taking place as ESD holders decide to stay or move on. But at least there is some clarity, in that the new model can be valued based on estimates of discounted cash flows.

If ESD can get to one billion of issued stablecoins, it will be investing $1B of reserves into DeFi. The annual yield on this will be a substantial flow of value. ESD DAO holders now own a share of these future flows. We just need to be creative and come up with new ideas to drive demand for ESD. The future is bright. It’s all to play for!