Empty Set Dollar Reborn?

Will Version 1.5 of Empty Set Dollar put it back on the path to price stability?

It has been about two thousand crypto years since our October 30th blog post on the Empty Set Dollar. So why the long delay?

The answer provides an important lesson on how to communicate in the world of crypto, where things can sometimes move so fast that any attempt to definitively capture the state of play is doomed to failure. We have held off on pushing previous drafts of this post because we couldn’t keep up with events. So we waited until things became clearer. We can no longer wait. This post is our attempt to embrace the uncertainty around where things are. We still don’t know what the future holds for ESD, so we thought it was best to speculate based on the hints that have been shared with the community to date.

There is another reason for the delay: we have been very busy growing the Complement Capital team. We are now a team of four people. We will put out a separate post to update you on our expansion, including more details on how our investment strategy is evolving.

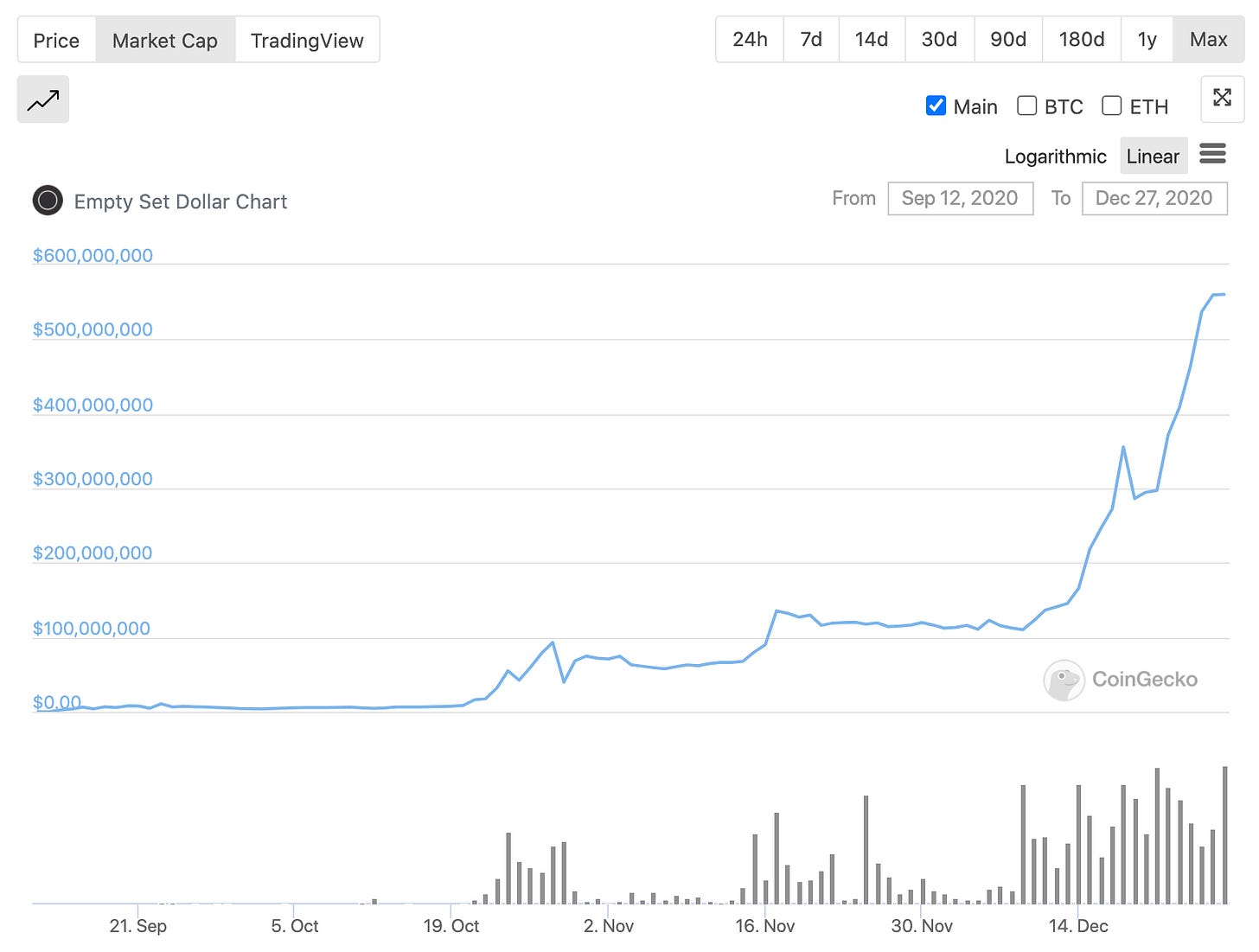

But first back to ESD. Here is how things looked at the end of last year:

So let’s recap on Q4. In October, when our previous blog post went live, ESD took a leading position in the emerging elastic stablecoin space. In an incredibly brief period of just eight weeks, it had risen from nowhere to a $68M market cap. By the end of the year, it had hit a market cap of $560M! The ESD community forum and Discord were thriving. Protocol ideas were coming in thick and fast. A proposal for ESD Version 2.0, put forward in a post by Scott Lewis and Will Price, had gained widespread support from the community. An ESD treasury was established. Copycat protocols started showing up (a sure sign of crypto success). Elastic stablecoins started to get widespread coverage in crypto media, podcasts, and blogs. Then the innovators arrived. New designs for partial-reserve stablecoins (e.g. Frax, the Fei whitepaper) started to appear. It was a crazy time.

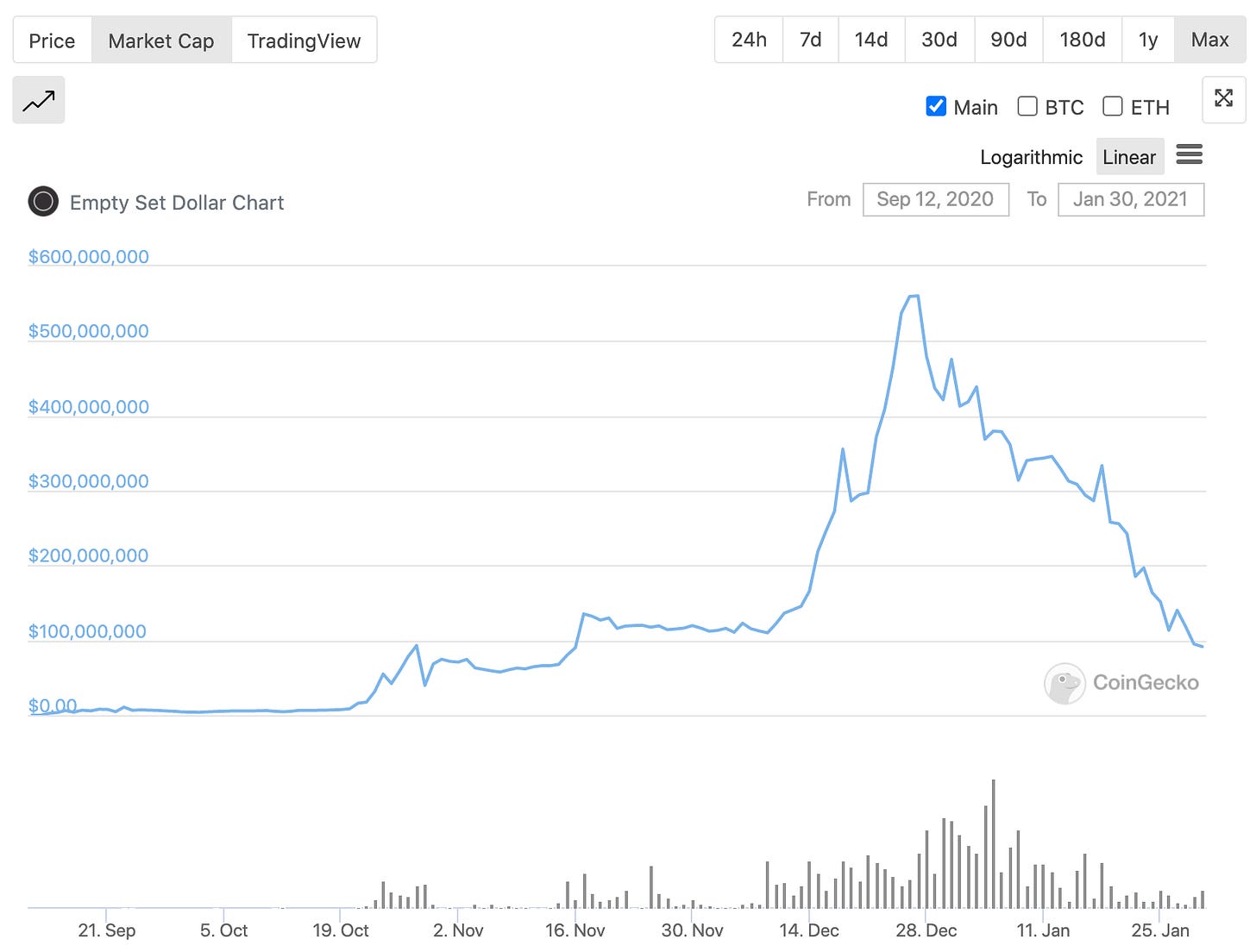

Over Christmas, we started drafting a follow-up blog post explaining the ideas behind Version 2. The previous post had finished up with some speculation on whether ESD could maintain price stability. By the time of the Version 2 proposal (in mid-November), it was already clear that the coupon mechanism, which was designed to absorb demand in a downturn, was not likely to work. Version 2 was designed to address this but markets move faster than software development, so the community didn’t get much time to fix things up before this happened:

Given the issues with the coupon mechanism, the incredible Q4 expansion in supply had only one place to go. When sentiment changed, it became a race to the exits in Q1. After a steep fall in January, the price seems to have stabilized in February, though the price remains well below peg.

So is that it? Is ESD dead? Many have already written off elastic stablecoins as a failed experiment and they may indeed be right. It may well be that mechanisms to dampen stablecoin price volatility with incentives alone will prove to be impossible. Maybe crypto-backed stablecoins are the way forward. Certainly, fully-backed stablecoins look robust. But partial reserve projects also look very promising. So maybe there is a way forward.

Crypto projects can be reborn. Havven was reborn as Synthetix. Sushi made it through a serious crisis to evolve into an incredible success story. And now we have some new stablecoin projects that can show ESD the way forward. Frax is doing a great job of maintaining its peg. Fei has some great ideas around using reserves as liquidity. It is also looking to invest these reserves. As a famous Irishman once said: “talent borrows, genius steals”. So can ESD can be reborn as a reserve-backed stablecoin?

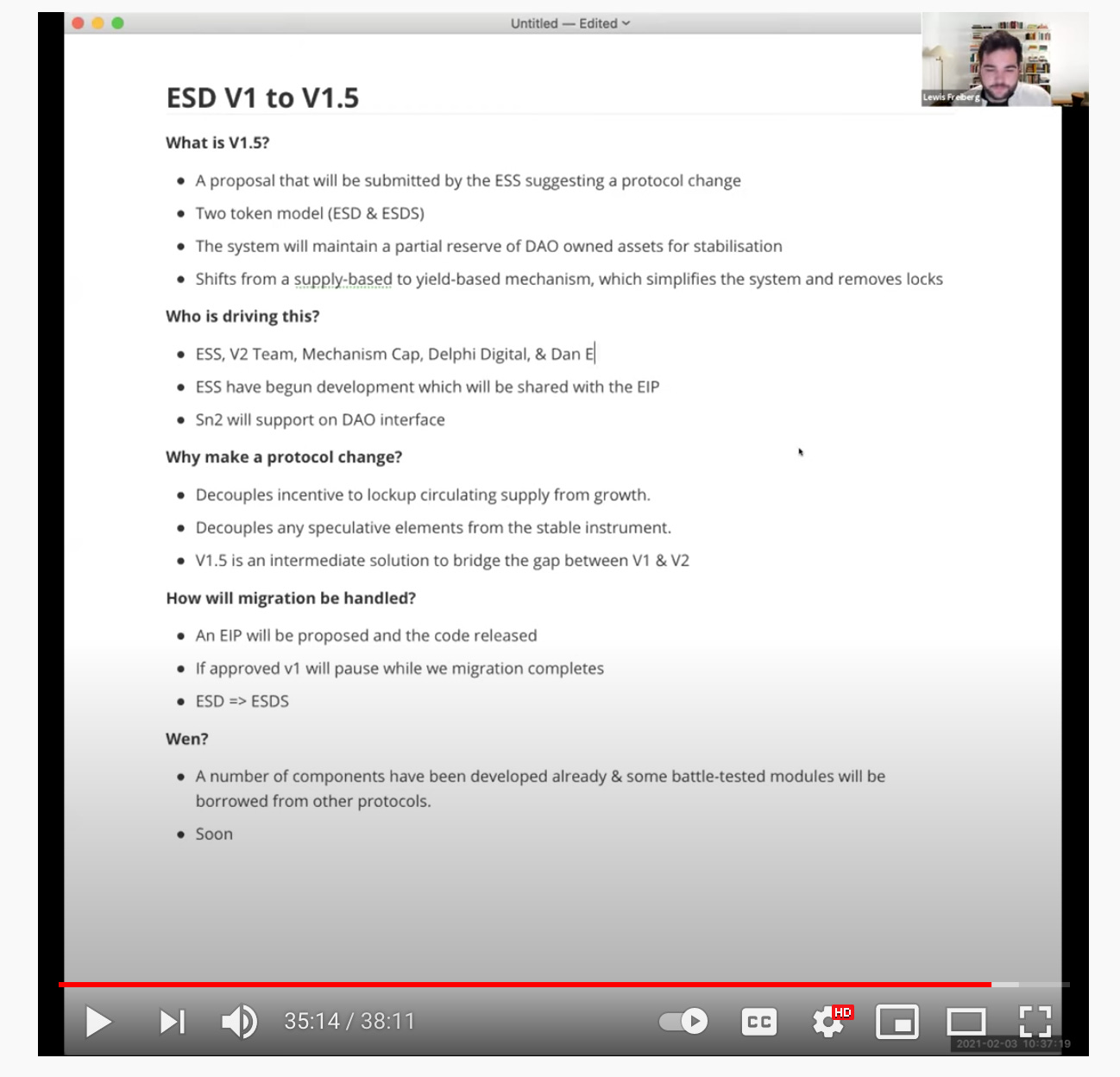

There are signs that an attempt to do just this is underway. The community has decided that V2 was too much to bite off in one go, so a V1.5 is in the works. The exact details are not clear right now but tantalizing clues were provided on a recent community call.

We can see above that V1.5 will use a partial reserve. It also moves to a two token model. It’s a shame that the one token approach has to go, as it was a cool idea and such an ambitious vision. But, in the end, it has proved impossible to make the design work with only one token.

What is really interesting is the move from “a supply-based to yield-based mechanism”. What is this likely to mean? ESDV1's supply-based instruments were referred to as coupons. Coupons were designed to soak up supply in periods when demand was low, where ESD holders could burn ESD to have a chance of getting more ESD in the future. A later governance change even changed the coupon mechanism to ensure that there was no risk of loss. But the coupon design was not powerful enough in the face of massive selling pressure in January. ESDV2 proposed zero-coupon bonds as a replacement for coupons. But it now seems that V1.5 is going in a different direction.

We can only speculate what the “yield-based mechanism” might be, as the details haven’t been announced yet. The Fei protocol plans to invest their partial reserves in liquidity pools, money markets, and other yield-earning protocols. So maybe this is the V1.5 approach. In the Fei model, the protocol invests its reserves in yield-bearing protocols in the good times, so that it can accumulate a financial war-chest to serve as a protocol defense fund in bear markets. So potentially this is what the Empty Set Squad means by “yield-based”.

This raises the question about how the partial reserves will be bootstrapped. This remains a big unknown right now. Will existing ESD holders be required to fund the reserve to get access to future seigniorage? Or will loyal ESD holders be rewarded for their patience, with the reserve being accumulated from new DAO members (as per the V2 proposal)? Could the recent Delphi Digital proposal to add a sales tax on ESD transfers (also discussed on the recent community call) be adopted as a mechanism to fund the reserves?

Seemingly we don’t have to wait too long to find out. The V1.5 details should be announced in the next week or two. At the time of writing, there is a 5x bounty available to anyone who believes that V1.5 will restore ESD back to the peg. At Complement Capital we don’t believe ESD is dead. In fact, we have increased our ESD holdings in this period of low demand. But this is not investment advice. DYOR! But it does seem likely that ESD will come back with a much-improved design. It may soon be reborn.