The Empty Set Dollar: Premium Superfluid Collateral

An introduction to ESD and why it is such an important DeFi project.

The project docs call it a “decentralized self-stabilizing dollar”. Robert Leshner, the Founder of Compound Finance, has called it “a new algorithmic stablecoin”. The ESD white paper calls it “an elastic supply stablecoin”. But what exactly is the Empty Set Dollar or ESD? Here we argue the case that it is one of the most important building blocks in DeFi.

A Brief Overview of ESD

Before I start let me make a quick note about some of the parameters mentioned below. Various settings like epoch length, coupon expiry periods, percentages of supply distributed to bonded token holders and bonded liquidity providers, etc. are all subject to governance changes. The parameter values used in this post represent their values at the time of writing (November 4th, 2020). This post was updated on November 4th to reflect changes to the debt mechanism approved by a governance vote on November 3rd.

ESD is a crypto token with coded rules about supply expansion, so it is algorithmic and the supply is elastic. But neither of these descriptions accurately capture the fundamental assumption that is at its core: that a collection of anonymous, self-interested individuals can act as a reliable mechanism to stabilize an on-chain representation of the US Dollar (a USD “synthetic” or “synth”), causing it to maintain par with USD. With ESD there is no need for fully-backed reserves. It is an asset where stability is the by-product of a set of rules incentivizing human behavior. Let’s start with a brief overview of how it works.

The Empty Set Dollar or ESD is a synthetic asset, much like MakerDAO’s DAI or the Synthentix sUSD. Its goal is to maintain price stability by tracking the value of the US dollar. A Uniswap liquidity pool containing USDC and ESD is used as a price oracle. The ESD mechanism is designed to allow the ESD supply to expand, while at the same time aiming to get to a position where there are equal amounts of ESD and USDC in the liquidity pool so that 1 ESD retains its value at 1 USDC (and hence $1 fiat).

Side note: ESD currently works on an eight hour cycle, where each eight hour period is one epoch. At the epoch transition, the ESD smart contract checks the price of ESD. The price of ESD is not measured at the instantaneous moment of the epoch boundary, otherwise the price could be subject to manipulation. Instead ESD uses Uniswap’s time-weighted average price (TWAP) algorithm, so the measured price is the average over the previous eight hours weighted by the amount of time it stayed at each price. To give the reader an intuition about how it works, if the price stays at $1.05 for the first six hours of the epoch and then at $1.02 for the remaining two hours, then the TWAP price might be $1.0425 i.e. 3/4 of the way between $1.02 and $1.05. And if someone does a huge ESD buy two minutes before the end of the epoch, to move the price to $1.50, this will have a negligible impact on the TWAP price.

If ESD is valued at more than 1 USDC, the smart contract assumes that demand for ESD is too high to be met by the current supply, so it increases the supply by minting more ESD (we’ll explain how this newly minted supply is distributed later on). Each epoch, the protocol will continue to increase the supply until the total supply is in line with total demand, in which case the price will fall back to $1. If too much is minted or there is an external drop in demand, then the price will fall below $1. The protocol has no way of knowing if the supply expanded too fast or if there was some external cause for the fall in demand. So it has a unique mechanism called coupons that help to get the system back to peg.

But before we get to coupons, we need to introduce another related concept: debt. The protocol creates debt when the TWAP price is below $1 at the end of an epoch. The debt accumulates in the protocol over time, so if there are multiple epochs when the ESD is below peg, the debt keeps getting bigger. In this way, the accumulated debt captures the lack of demand over time. There can be no new ESD distributed until the debt is paid off in full. When the ESD price goes above peg, any new supply created pays off coupons first and then debt, before anything is distributed to token holders.

Coupons are the backup plan when the ability to buy ESD on the market for less than $1 is not enough to restore the peg by itself. If the price gets stuck below $1 for an extended number of epochs we need a way to get things moving again. Coupons incentivize token holders to voluntarily burn their ESD, by offering them coupons redeemable for future ESD. These coupons are priced at a discount so that the holders who acquire the coupons get rewarded for taking the risk. During short spells of low demand, coupon discounts are very low, so there is little incentive to take on the risk of buying coupons. As more debt accumulates, the coupon discounts become steeper and so more attractive returns are available to those who buy coupons. But there is one seriously big catch: the coupons expire after ninety epochs (currently this equates to thirty calendar days)! Coupon purchasers need to be very confident that the lack of demand for ESD is temporary. Otherwise, their investment in coupons will be wiped out. Coupons are not at all intended for use by retail investors. The expectation is that this is a role best taken on by professional investors. To see why let’s take a step back and see how the system is designed to work.

We can think of accumulated debt as the “memory” of the system. Debt is “remembers” the bad times. However, debt is not designed to be a price stabilizing mechanism. The primary stabilizing mechanism is a belief in the system and that ESD will converge on a value of $1, where anytime it goes below $1, traders can profit by buying it cheap and selling it at the peg. The calculus is whether the difference between the current market price and $1 is greater than the likelihood that ESD does not return to $1 within the trader’s expected timeframe. The debt mechanism provides a record for the system of any recent spells of weak demand so that the system has a way to calculate how many coupons to issue. Once we return to peg, the debt is reset to zero and no new coupons can be issued. If we drop below peg again then the cycle starts again, with debt accumulating from zero and with low coupon discounts.

Coupons, on the other hand, are designed to be used to restore the peg after prolonged periods of below peg trading. Investors can step in to buy the debt because they have a strong conviction that demand is increasing or about to increase. And they make this decision with skin in the game. If they are wrong, and the debt is not cleared before they can redeem their coupons, they lose the ESD they invested to buy the debt. If they are right, they earn the delta between the (below par) ESD trading price and $1 plus the extra ESD from the coupon discount. The investors who bought the coupons can also do something that the protocol itself cannot do: they can generate demand. In reality, we expect that only those with significant financial resources will be capable of wielding coupons effectively. These professional investors will take no chances: they will buy tokens to drive up the price and keep it above peg until the debt is paid off and they have redeemed their coupons. This is why ESD is not a purely algorithmic stablecoin. It is a system that combines algorithms with the actions of incentivized users to achieve price stability. But coupons are not recommended for use by inexperienced investors, as they are likely to face large losses if they cannot accurately time their coupon purchases.

A typical situation where coupons will come in useful is when ESD is trading just below peg for an extended period of time. Let’s say ESD is trading at $0.98 for three epochs. It’s not a big deal but it causes issues for some ESD users who need to liquidate a position but don’t want to take the price hit. Debt will have accumulated during the three epochs, so the discount on coupons will have built up a little. Now an arbitrageur can step in to make a gain. Previously there was a small reward to move the price back to peg but it obviously wasn’t attractive enough for arbitrageurs to take. The extra coupon incentives could be enough to change this decision from “don’t make the trade” to “make the trade”. And if not, then the coupon discounts will keep ticking up until the arbitrage opportunity is attractive for someone.

Once the stability mechanism does its job and demand returns, the price of ESD may start to creep up over $1. Every time an epoch ends with the TWAP price above $1, new supply is created and the debt is reset to zero. This new supply first fills up an ESD pool for coupon redemptions. Coupon holders can redeem their ESD on a first-come, first-served basis. Only when there has been enough ESD minted to cover coupon redemptions are fresh ESD tokens minted. Which brings us back to the open issue of distribution: which users are lucky enough to get the newly minted ESD?

To answer that question we must dive into the DAO. ESD was born decentralized. It was created with on-chain governance from Day 1. The system can only be upgraded by a vote that passes with a quorum of token holders. Those who partake in this DAO, by bonding their tokens, receive a pro-rata share of 80% of the newly minted tokens in a supply expansion. The remaining 20% are distributed to those who provide liquidity in the Uniswap ESD-USDC pool. Liquidity providers are also required to bond their Uniswap pool tokens to earn rewards. By bonding ESD and Uniswap pool tokens, these holders are subject to some restrictions. For example, both groups will have to wait one epoch after unbonding to move their tokens and DAO members who partake in a governance vote will have their bonded tokens locked until the outcome of the vote is decided.

Does It Work?

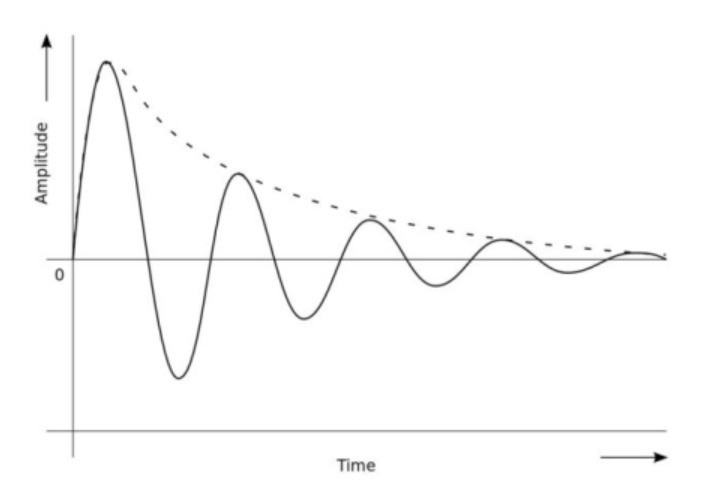

Is the protocol design working so far? The graph above shows a fairly typical diagram of a self-stabilizing system that you might see in any book on system dynamics. The idea is that many control systems can be slow to respond at first, where the system overshoots and then undershoots the target value. The system responds to these swings and adjusts some internal state to reduce the amplitude of the swing until eventually the control mechanism brings the system within some small margin of the target value.

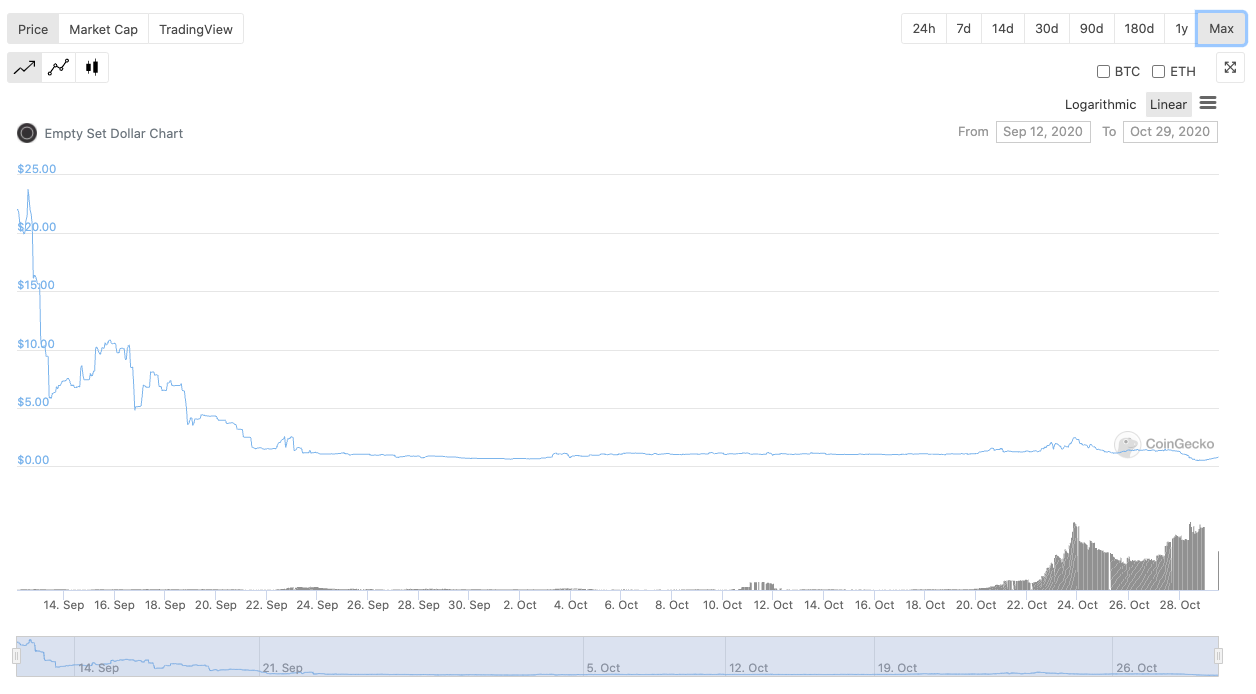

ESD is still working through this process, so it’s too early to tell how well things are looking for the long term. It is just coming to the end of the second full cycle. Below is the system history so far. As you can see, the first cycle hit values as high as $24. In fact in the bootstrap phase, just before CoinGecko added support for ESD, it traded at even higher valuations per token (which, by the way, was a rational valuation based on the high inflation rate during the bootstrap period). You can see that the second cycle, which looks like a tiny wave compared to the first cycle, was much closer to $1 than the first.

Below we zoom in on the second cycle, to get more insight into what is happening:

We can see that in the second cycle, it peaked at about $2.40, dropping down to $0.43 (in fact, it might have dropped even lower for an instant but this is not captured in the CoinGecko data), before recovering to peg on November 3rd, 2020.

We can see that, so far, it’s behaving as predicted. The initial design appears to be working well. The system can certainly be tuned, and we fully expect that governance decisions will be made to change some of the system parameters and to adjust the incentives. But the expectation is that, as we go through more cycles confidence will build in the system, and so traders will price in the expectation of a return to peg and therefore they will be more inclined to buy ESD below peg and sell it when it trades above the peg. The predictability of the system will draw in professional arbitrageurs. Over time the competition between arbitrageurs will dampen the cycles so that ESD trades close to the peg.

Premium Superfluid Collateral

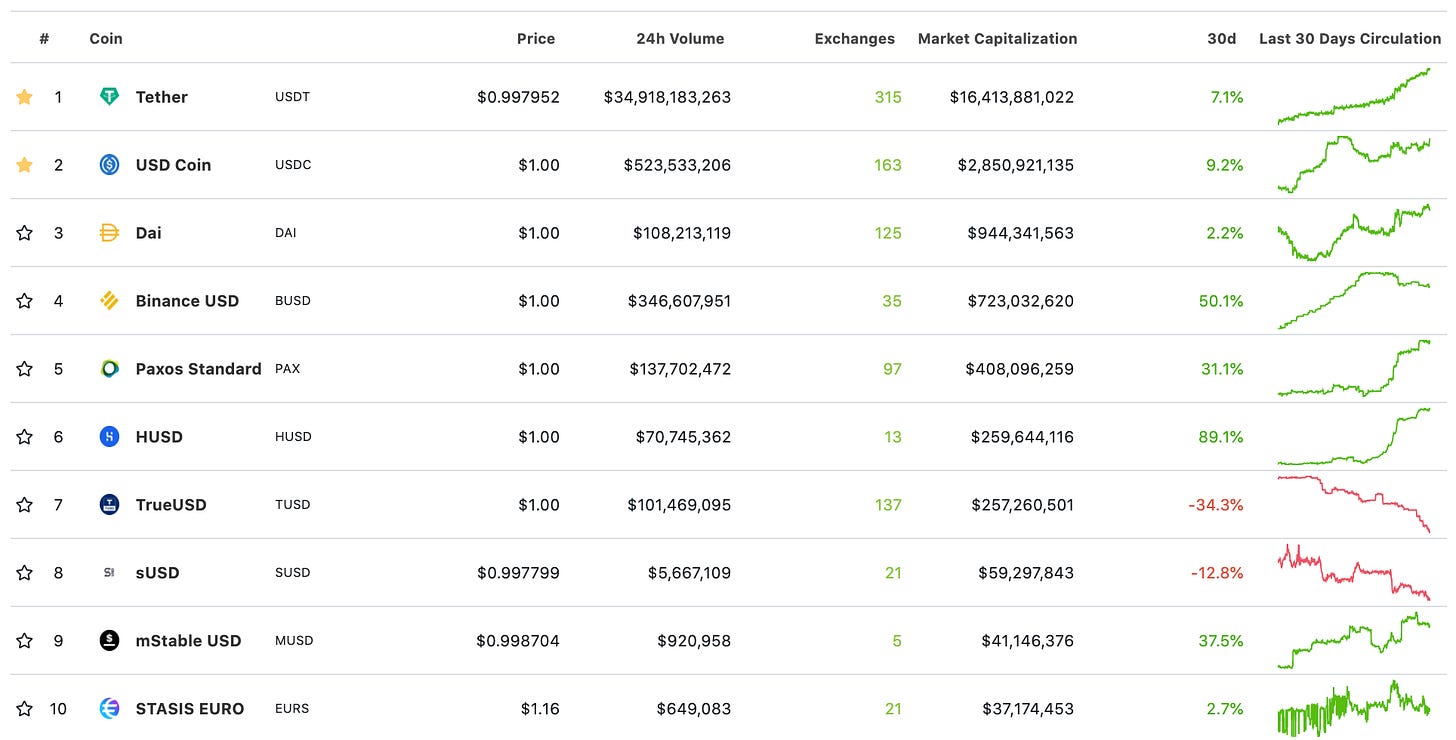

While we have also seen a diverse range of interesting, decentralized stablecoin designs (e.g. Terra, Celo, MakerDAO), the centralized competitors like USDC, Tether, and Binance retain a huge advantage in terms of market share. Crypto genuinely needs stablecoins that are not subject to the regulatory risk and censorship potential that centralized tokens entail.

But there is a bigger reason why ESD could become one of the key building blocks of the new DeFi economy: it’s potential to become premium collateral. Quality collateral is fundamental to much (if not all) of DeFi. When a user borrows in a lending market (e.g. Compound, Yield, Mainframe, Aave) or mints a synthetic asset on MakerDAO, Synthetix, or UMA, the quality of collateral can impact both returns and user experience. To understand this better, let’s compare ESD to the king of DeFi collateral: ETH.

When ETH is used as collateral, price volatility is the major issue. The price of ETH is subject to significant volatility over time. In particular, it is prone to sharp price drops which can result in under-collateralized positions and liquidation. So when a user posts ETH as collateral, they need to over-collateralize even above the minimum requirements of the system. This is a seriously inefficient use of capital. But worse than that, the borrower / trader is now subject to margin calls. If they are not prepared to step in with more collateral or to repay their loan at short notice, they might find that their collateral is wiped out in the space of minutes. Not only is this a really poor user experience for the collateral provider, but the panic selling of collateral in this way also creates systemic risk. The price drops can cause other holders to sell, which then triggers more margin calls, and a downward cascade can occur. With today’s Ethereum technology, this can also lead to network congestion which exacerbates the problem.

But what if we don’t use ETH? What if we use a stablecoin as collateral? This removes the concerns around volatility. It allows for a patient unwinding of bad debt. When a trader loses out on a synth trade and they cannot meet a margin call, the situation can be unwound in a calm and considered manner, rather than as a panic sale because everyone is confident that the collateral will hold its value. If the stablecoin drops below peg, the situation is likely to be temporary. So the protocol / lender / trader who takes the other side of a synth trade can accept the stablecoin collateral in lieu of what is due to them, knowing that they can sell it in due course. But the key downside of stablecoin collateral is that a user’s stablecoins are locked up and not earning a return. It is therefore incredibly capital inefficient as it will lead to lower investment returns.

Dan Elitzer has proposed a solution to this capital efficiency challenge in a post entitled Superfluid Collateral. In this model, collateral is bonded but liquid. It is bonded in the sense that it is reserved for use as collateral and can be liquidated at short notice. But it is also liquid in the sense that while it is bonded, it can be lent out or used in some way that earns a return. So doesn’t this fix the capital efficiency problem? Well, yes it does. But maybe we could do better.

When I hold ETH as collateral, I hold a position in an asset where the price is likely to grow in line with the overall growth of the DeFi ecosystem. In this way, ETH has equity-like characteristics, in that it captures value generated by the growth of the crypto market, by being highly correlated with such growth. Holding ETH is a little like buying a DeFi ETF. This is what users want from their collateral. They want it working on their behalf. Superfluid collateral that gets a user exposure to money market rates is great, but the interest rate they earn on it may well be outpaced by the growth of DeFi. Users want superfluid collateral that acts as a DeFi ETF.

And this is where ESD comes in. Bonded ESD will grow in value as the demand for ESD increases. So if (and yes, it’s a big if!) ESD becomes one of the leading decentralized stablecoins in DeFi, then the demand for ESD is likely to keep pace with the growth of DeFi. And if (and yes, it’s another big if!) ESD can show itself to be price stable, then the volatility issue goes away and so does the need for over-collateralization and fire sales, and therefore the systemic risks that fire sales give rise to will also end. There are no more margin calls for collateral providers, so overall ESD collateral provides a much better user experience.

When a protocol accepts ESD as collateral, it can be coded to tolerate when ESD drops below peg from time to time, knowing that ESD’s stabilizing mechanisms allow it to return to peg quickly. Like ETH, ESD has similar investment characteristics to a DeFi ETF. This combination of low volatility and DeFi value capture makes it the premium form of superfluid collateral. It is collateral with characteristics that make it much more attractive than any alternative.

How realistic is this thesis? Well, there are a lot of challenges. Firstly, there is competition from MakerDAO and the centralized stablecoins. This market is heating up with more new competitors arriving every week, so there will be intense competition. There is certainly a risk that ESD won’t manage to grow in line with DeFi growth. Secondly, there remain unanswered questions about how stable ESD will become in the long term. The mechanism is likely to evolve as the ESD token holders tweak the system dynamics. There is also some degree of risk that the stabilizing mechanism won’t be up to the job, especially given the ingenuity of an army of DeFi hackers looking to break the stability mechanisms. Thirdly, it could be that ETH’s volatility declines over time, in which case it could retain its dominance as the king of collateral. These are all very real risks.

However, we are excited about this vision of the future and can’t wait to see how the experiment plays out. With ESD, a user can invest in a token that can grow in value with DeFi growth, that is price-stable when they need to spend it, and that they can lock into lending markets, synth trading apps, and new protocol lockdrops when they want to earn higher returns. This sounds to us like an amazing innovation!

Please check out the ESD app at https://emptyset.finance

Please read the white paper, and do your own research here, here, and here.

Please sign up for this newsletter to get more insights into DeFi strategy and new and upcoming protocols.

Full Disclosure: the Complement team are ESD holders.